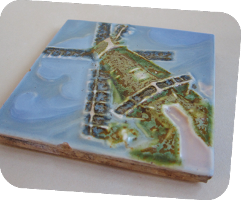

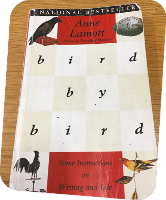

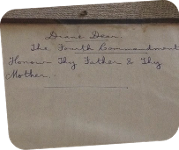

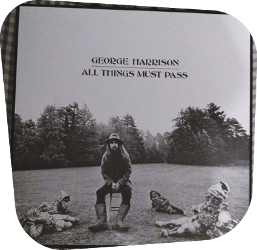

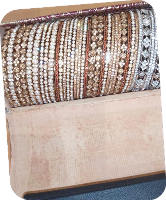

This is Me

Residents across Hillingdon have been sharing photos of different objects that they own and which represent them. These have helped us create our 'This is Me' project, which tells the stories, history, heritage and lives of people living in the borough today.

Thank you to everyone who's already contributed, including Hillingdon Women's Group, Bell Farm Christian Centre's over-60s' lunch club and attendees of the council's dementia coffee mornings.